At this point you have heard about what happened in the stock market last week. You have been hearing the words Gamestop, short, hedgefund, Robinhood and so on in your feed in some form or another. The story is big. It has so many moving parts and could seem really intimidating for most of us who have no idea how any of that stuff works.

To be able to completely and thoroughly understand what happened last week, would take a lot more than reading a blog post. Especially this particular post, as I am in no way an expert in this area. So I naturally thought it would be fitting for me to give you a breakdown. Don’t worry I googled, watched MSNBC, and asked my husband to explain about 100 times. I got this. Ready?

The story is not that simple. Nor did it happen overnight. I am going to try my very best to explain this as quickly and easily as possible.

First there is the original Reddit post, which noticed that some hedge funds were taking a “short” position on Gamestop. This came about 190 days ago. What is a “short” position. In it’s most simplest form, it means to bet against. So these hedge funds commonly “short” certain stocks, and while it is risky it usually ends in a big pay day, and it’s a way the market sort of self corrects.

*If you have not seen The Big Short– highly recommend, helps you understand the financial fiasco of 2008 and the cast is incredible: Steve Carell, Ryan Gosling, Brad Pitt, Christian Bale, Kendall from Succession, with appearances from Pharell, Selena Gomez, Snoop Dog, and this one here from Margot Robbie who gives you a quick “short” explanation.

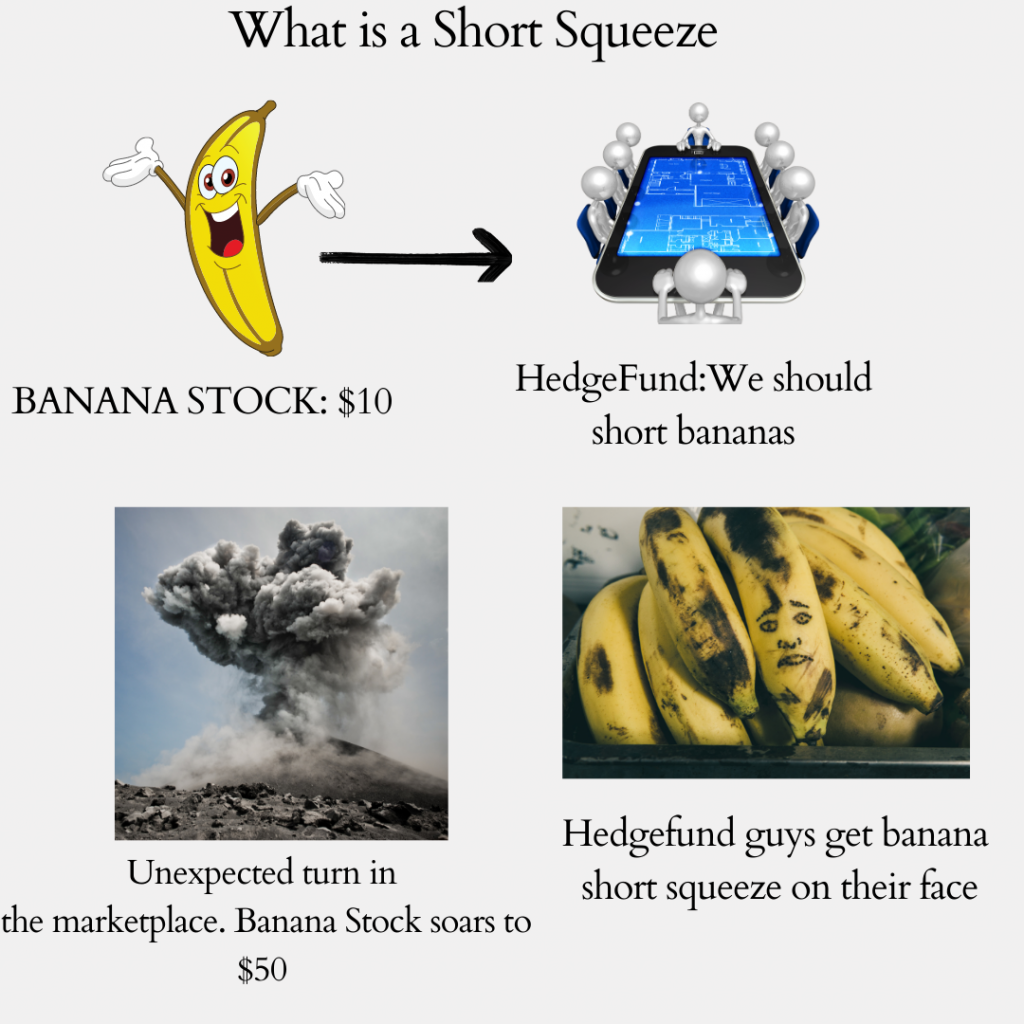

Usually the companies that are the target of the “short” are failing or have diminishing returns and are on the way to failure. They do not usually begin to improve. THIS IS IMPORTANT because if anything was to happen such as the company gets bought out, or creates a new patent or gets a drug approval, this would cause “a short squeeze” and as the price of the stock rises, these companies have to pay the difference with interest. A short squeeze is bad, because it means their bet didn’t work out.

So if I’m a fund and I want to short the “Bananas” their stock is at $10, things are not looking good for “Bananas” company, it hasn’t been doing well for a while. But alas! Looks like it’s pandemic and banana bread is the new flourless cake. Everyone wants bananas! Bananas are taking off and now their stock is worth $50. My short has been squeezed. I’m covered in banana puree.

Shorting a stock isn’t free. Whoever is taking the short position borrows the stock. In a very complicated manner that probably no one really understands, the short buyer, in this case the fund, will now owe the broker, to get out of the short, they will buy the stock at its current price, thus paying the $40 difference plus interest, fees…

Gamestop, which is considered to be in a dying brick and mortar industry, wasn’t the “blockbuster” company you might have thought it to be. It had $100 million in net cash, so bankruptcy is not as imminent as many short seller may have made it seem.

Now, back to the story. After the original Reddit post, some time passes, and two eccentric big name investors come into the story.

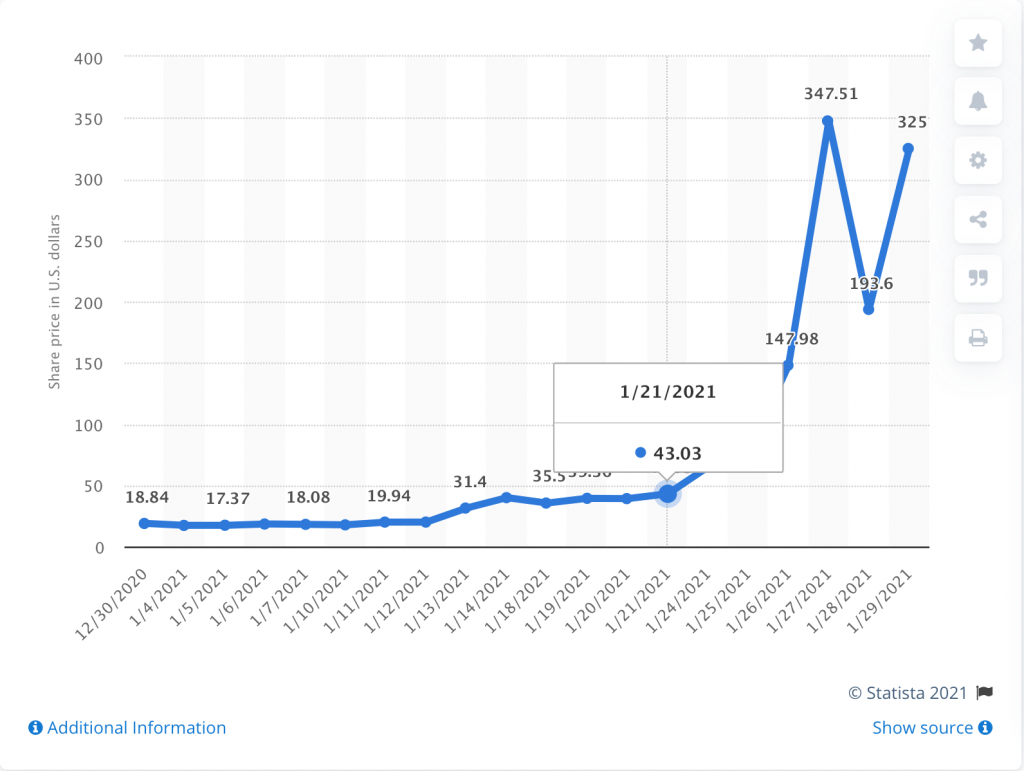

Enter Florida. Because a guy from Florida is always involved. Ryan Cohen is the former CEO of Chewy.com, whom famously took his 3.3 billion dollar buy out and only invested only in Apple and Wells Fargo, for the last 3 years. Until Gamestop (GME). Cohen took out 6.2 million shares of GME on August 31 (raising the price of the stock, limiting the amount of available stock, and signaling Gamestop may have potential).

This leads to Michael Burry (Christian Bale’s character in The Big Short), taking notice and he began to see the short position and decided to buy a significant amount of shares (again raising the stock price and limiting the amount available). The Reddit plan was going according to plan.

The hedge funds had to make a decision. Continue paying the fees on their short positions, or close out their short positions by paying the much inflated new price of the stock.

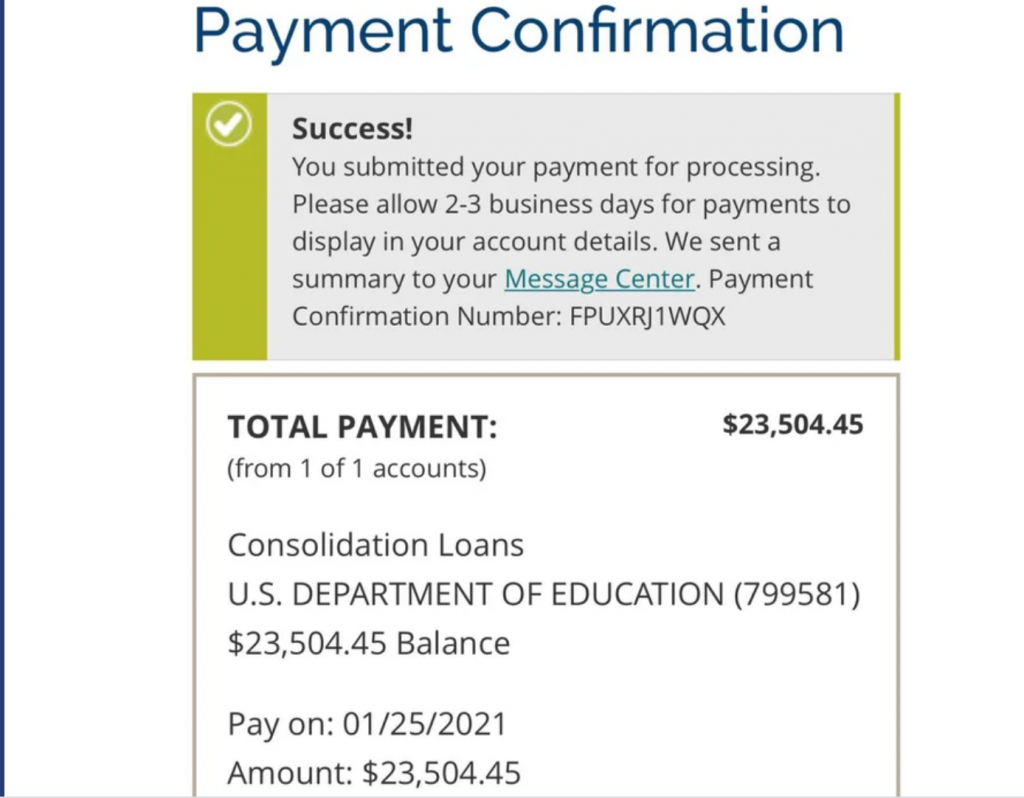

At this point Gamestop has gone from being valued at $17 in early January to being valued somewhere at almost $400. The people who got in early, and were able to sell made up to $13 million. It led to stories like this:

Some hedge funds are estimated to have taken a hit of about 5 billion and had to be bailed out by the other funds. They will live to short another day.

Proving my earlier point about there always being a South Florida connection. The owner of one of these hedge funds recently purchased not one but two homes on North Bay Road. Ah… Florida.

I’ve really simplified this. There are so many layers here. Some other stocks were in play like AMC (as in the movies) and Nokia (as in the flip phone you played snake on). I am trying to just pull out the meat and bones for you because what has happened here is historic. Never before has “the little guy” been able to manipulate the system the same way big hedge funds do every day.

If you are into the story, this is a good starting place for you, if my blog was the first place you started to read about it: https://thehustle.co/01262021-gamestop/

This guy is also a great follow on Instagram and gives a great perspective on what is happening: Dave Portnoy (President, Barstool Sports)

Click here for the 50 Best Memes on Buzzfeed like this one:

I left Robinhood and how they were involved out here which is a big part of the story. Nutshell: There is suspicion that Robinhood, stopped selling the GME stock in order to help the fund from losing more money. Robinhood argues that they just were maxed out and could not process any more purchases. There will be an investigation. Until then it is hard to say. I’m obviously going to keep following the story. Here are some links to get more information: